Finding A Broker for Your Gold Investment Venture

To give you the goods and services that a gold retirement account needs to start up and manage, Goldco collaborates with international mints, custodians, and facilities for storing bullion. The metals specialists at Goldco can help you pick from a variety of goods and services, including investment-grade gold bars and pieces, financial solutions, and gold storage. They can help you locate the one that best suits your requirements.

It makes sense to include gold investments in your pension plan if you want to build a more diverse portfolio of assets. This might involve buying stock in a gold company or acquiring gold coins and bars directly. A Goldco 401k transfer can be an excellent alternative for you to think about if you are searching for a new home for the 401(k) funds that do not closely track the stock markets or the economy.

Despite this, you should diversify your investment portfolio. Ensure that your retirement plan includes a variety of different asset classes. As a consequence, you are going to be more protected against danger. People have used gold to pay for things throughout the history of civilization.

Gold investments are not limited to just one type of investing, as there is a big market for bullion mutual fund investments, futures, mining, and jewelry. Before deciding who to invest with, be certain to read the Goldco review and weigh your options for investment assistance. With rare exceptions, the only ways to invest directly in gold are by purchasing bullion, options, and a few specialized funds. The value of other investments comes in part from outside sources.

Silver or Gold Bullion

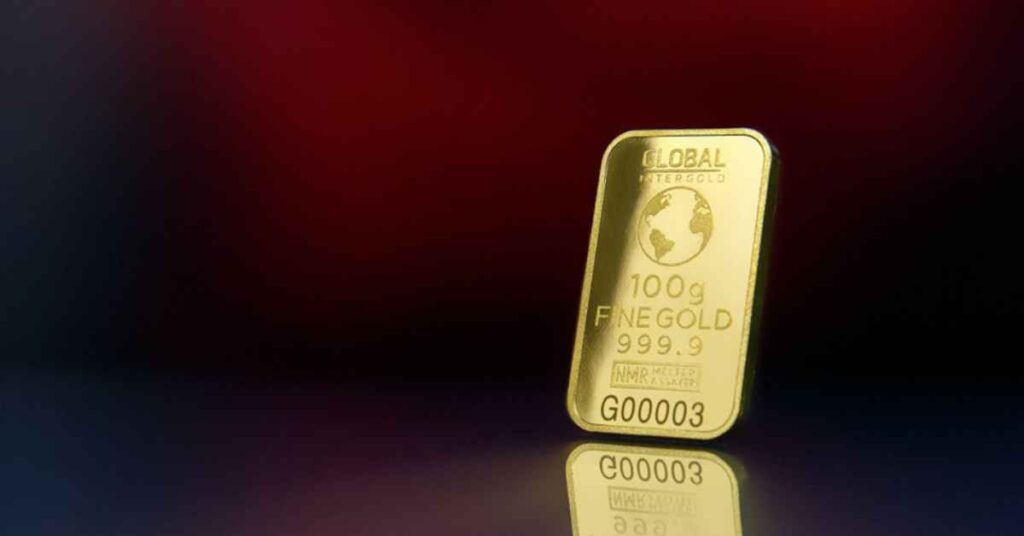

This type of direct bullion ownership is maybe the most well-known. Bullion gold is frequently associated with the enormous gold bars kept in Fort Knox, Kentucky. Actually, a kind of pure or almost pure gold that has been laboratory-verified for its density and purity is referred to as gold bullion.

This includes gold bars, coins, and other gold-containing objects of any size. Additionally, gold bars frequently have a serial number affixed for security reasons. Although big gold bars (up to 400 oz ounces) are spectacular to see, their illiquidity makes them expensive to acquire and sell. Click here to learn how to translate troy ounces of precious metals into other weights.

For example, you cannot exactly slice off the end of a huge gold bar valued at $100,000 and sell it if you opt to sell 10% of your whole gold holding. On the other hand, gold owners frequently hold bullion in smaller-sized ingots and coins, which offers much more liquidity.

Gold or Silver Coins

The world’s sovereign governments have been issuing a significant number of gold coins for many years. Investors often purchase coins from private dealers for a premium of 1% to 5% above the value of the underlying gold, although in certain situations, the premium has increased to as much as 10% in recent years.

The benefits of bullion coins include:

- Their price may be seen in international financial magazines.

- One ounce or smaller coins made of gold are often produced, which makes them a more practical form of gold investment than bigger bars.

- Without much effort, trustworthy dealers may be identified in many major cities.

In addition to the intrinsic worth of the gold, older, uncommon gold coins additionally have what is referred to as numismatic or “collector’s” value. Focus on regularly used coins but leave the unusual coins to collectors if you want to invest just in gold.

The primary issues buying gold bullion include the dealer’s relatively high markup and the fees associated with storage and insurance limiting the amount of money that can be made. Additionally, investing in gold directly by purchasing bullion means that the value of one’s assets will fluctuate proportionately for every dollar that the value of gold changes.

Other gold investments, including mutual funds, can potentially be made with less money and might not be as directly price exposed as bullion.

Futures or Options on Gold

Futures are contracts to purchase or sell a set dollar amount worth of a particular asset—in case in point, gold—on a future date. Standardized contracts (https://study.com/learn/lesson/futures-contract-finance-examples-purpose.html) represent a set dollar amount of a particular bullion. Although it is still a popular way for people to add to their retirement accounts, it is not the most popular way to purchase bullion.

Because they have far lower margin requirements than standard equities trades and much cheaper costs, futures are commonly employed in financial transactions. Since some contracts settle in dollars while others settle in gold, investors must carefully study the contract specifics to avoid being required to provide one hundred ounces of gold prior to the settlement date.

Options on futures are a substitute for buying a futures agreement outright. These provide the option holder with the ability to buy the futures contract within a set time frame and at a defined price. Leveraging your initial investment and avoiding losses on the amount paid are two benefits of using options. A futures contract bought using leverage can need more money than was initially pledged if losses grow quickly.

The disadvantage of an option is that the shareholder must pay a premium above the actual value of the gold to acquire the option, unlike a future savings, which is based on the current price of gold.

Options and futures contracts may not be suited for many investors due to their volatility. However, futures maintain the least expensive option to acquire or sell gold when making sizable investments (after fees and interest charges).

Gold Mining Organizations

A rising gold price will also be beneficial to mining and refining businesses. Compared to other investment strategies, investing in these firms might be a risk-free way to earn from gold.

The biggest gold mining firms have significant global operations, therefore business characteristics that are typical of many other big businesses contribute to the success of an investment like that. As a consequence, even when gold prices are stagnant or falling, these businesses may still turn a profit.

One method they achieve is by regularly hedging against a decline in gold prices. Others choose not to do this.

Even so, investing in gold through gold mining firms could be safer than buying gold bullion outright. The investor must use due care in both researching and choosing the specific firms. This is a laborious project, so many investors might not find it practical.

A Diversifier: Gold

Gold has historically been seen as a buffer against economic downturns due to its poor connection with other forms of financial assets. In particular, gold has traditionally had no association with stock market performance, and gold tends to move in exactly the opposite direction from the dollar. This implies that times of weakening of the dollar may result in an increase in gold prices.

When faced with the prospect of a recession, investors may start to consider the advantages of gold as a form of insurance against falls in other asset classes. According to past trends, gold prices often rise when inflation-adjusted bond rates decrease.

This means that investing an amount of your wealth in gold as a buffer against slow periods of economic development may be wise.

Is Gold a Wise Investment in a Downturn?

A lot of investors include bullion in their investment portfolios as a hedge against prospective economic downturns due to gold’s historically modest association with other forms of financial assets. When bond rates decrease, gold prices often rise.

The efficacy of gold investments during recessions or any other stages of the financial cycle will rely on how they fit into your entire investment plan, even if there may be advantages to doing so. Basically, if you are sure to diversify your retirement investment portfolio to the point that no single financial asset declining in value can throw off your retirement plans, then by all means, look into bullion or futures investing.

Just be certain that in your planning, you leave enough of a cushion that if the price of the ingots drops suddenly, you will not have to work another decade to offset the loss.

The Bottom Line

Larger investors that want a direct connection to the gold price can decide to buy gold straight through bullion. Owning a tangible item as opposed to just an item of paper also brings with it a certain amount of comfort. The tiny price premium over the gold’s initial purchase price and storage expenses are drawbacks.